WHAT IS THE PHASEDOWN?

The phase down in gasses will begin January 1, 2022. It requires the reduction of production and consumption of HFCs and will mostly impact FM-200 (HFC-227ea) and ECARO-25 (HFC-125). It's important to know this is a phase down and not a phase out. It’s not a complete elimination of HFC chemistries but it will affect the availability and the price of HFC gasses.

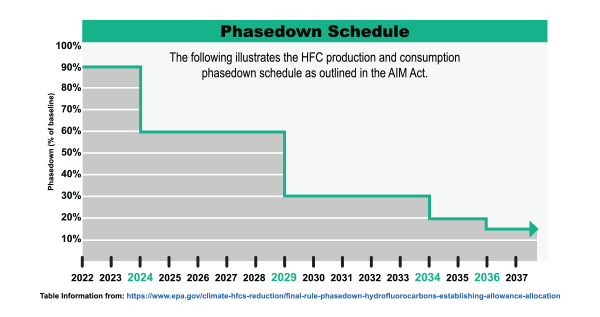

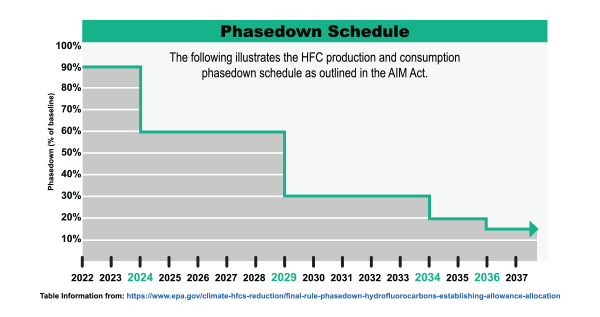

The law requires the determination of a baseline for HFC production in the United States. As its written it uses 2011 -2013 as its baseline. Beginning in 2022 there will be a reduction in the amount of gas that can either be produced or consumed. For the years 2022- 2023 it allows 90% of the baseline and then every few years after that there is a further reduction in the amount of gas finally landing at 15% of the baseline production in 2036.

What’s important about the way the law is written, it gives us a long time for the industry and the chemical manufacturers to find alternatives to replace FM-200 and ECARO-25. Some of the market impact you need to know about is first, HFC gasses will still be available. If you have standardized on FM-200 and ECARO-25, you’ll still be able to buy those gasses for those new systems. If you have an existing system and it discharges, gas will still be available to recharge your systems and you will not have to replace your system.

WHAT ARE THE COSTS?

The reduction in the availability of these HFC gasses is going to make them more expensive in the long run. It’s possible that in the future it could make them harder to obtain because there will be less gas on the market.

Regulations begin in 2022 with an initial 10% reduction. The fire suppression industry has already actively been moving toward that goal, resulting in a cost increase of virgin HFC Agents. FM-200 (HFC-227ea) cost increases of 500-800% have begun in late 2021. ECARO-25 (HFC-125) prices are also expected to rise nearly 50% in 2022. ECARO-25 is seeing a less dramatic increase because the chemical is used for several applications other than fire suppression and higher production rates will hold down costs.

The law creates a system of HFC allocations for manufacturers and retailers. The companies with allowances can create or import HFCs according to the size of the allowance they hold. The law also creates exchange values (EV) for HFCs according to their global warming potential (GWP) values. FM-200 and ECARO-25 fall in the upper third of the 24 blends of HFCs that the law regulates.

The EV and demand for a particular chemical will influence allocation holders to produce one or more products over another. With fire suppression agents being a small percentage of the manufactured base of HFCs, the scarcity of FM-200 and ECARO-25will be driven up in coming years.

There is a secondary market which exists today for recycled fire suppression agents. As fire suppression systems are decommissioned, third-party companies purchase the gas in the fire suppression cylinders and hold it to sell to other fire suppression system users. This secondary market has traditionally been used for system recharge or for system users who are looking for a cheaper alternative to

virgin gas.

Agent recyclers in the U.S. see a repeatable consumption rate of their products year over year and have gas banked for years of future consumption. It is predicted there is a suitable supply of FM-200 and ECARO-25 available for system recharges waiting at agent recyclers. It should be noted that recycled gas before being re-sold is tested for purity standards according to the Halon Alternatives Research Corporation’s Code of Practice for Use of Recycled Halogenated Clean Agents1. Pricing for recycled agents may fluctuate with demand but have historically remained steady and we expect that to continue.

What are alternatives to the regulated HFCs?

The good news is, we have alternatives to FM-200 and ECARO-25 primarily found in 3m Novec 1230 (a chemical clean agent gas) and inert gas systems. The inert gasses commonly used are IG-55: Kidde Argonite & Fike ProInert, IG-541: Ansul Inergen & IG-100: straight nitrogen. We also expect new products to come to market. We know through our industry involvement that many companies are working on alternatives to bring to the market for use in the clean agent space.

There are still other alternatives you should be aware of depending on the fire hazard and the types of fires experienced in those locations, there may be other systems than clean agents that may be appropriate.

Water mist systems have a number of manufacturers that sell into the United States markets with different products designed to address different kinds of fires. Carbon dioxide systems, while highly dangerous to human occupancy, have many industrial applications that are highly appropriate and commonly used.

There are a few things you need to be aware of with regards to designing clean agent systems after the AIM act goes into effect. Existing rooms that have FM-200 and ECARO-25 shouldn't be mixed with other agents. That's already prohibited in NFPA 2001 the standard on clean agent fire extinguishing systems. Expansions should continue to use FM-200 and ECARO-25 or whatever HFC gas is in place. New systems can consider one of the alternatives we have already discussed.

System manufacturers which produce inert gas systems have been developing larger bottle systems. Its been a concern when comparing halocarbon or chemical clean agent systems to inert gas systems, the amount of floor space inert gas systems can take up. These larger bottles help reduce the bottle count and shrink the amount of square footage needed in an area to install the system.

Finally, ORR Protection anticipates that inert gas systems manufacturers will come up with new calculations available for installers that will call for smaller pressure vent dampers to be installed in these areas because of the changes in valve technology on the platforms.

What are top questions people are asking about the AIM Act?

In a follow-up to the webinar, ORR Protection held a live Q&A event to help put our audience’s minds at ease. Lee, with other experts, Dal Brazzell, Dan Jasper, and Steve Nelson tackle frequently asked (as well as extremely specific) questions in a virtual round-table.

Watch the Q&A below:

Even though the Q&A has already taken place, we would still love to answer any questions you might have. Please fill out this form and we will get back to you right away.

Need a quick reference tool on this subject?

You can always come back to this page for the latest updates on how the AIM Act will affect the mission critical fire protection within your industry, but if you want to keep a quick cheat sheet handy for reference, download our one-page flyer.